Natural Gas Weekly Recap: The Weather Rug Pull & Vol Aftermath | Feb 1-5, 2026

NG's wild week - an 80+ cent sell-off, March vol crushed 32%, and the winter rally narrative gets tested. Free weekly market recap.

Energy Volatility Intelligence

Valor Analytics is the energy volatility intelligence layer for institutional desks, combining intraday options flow, dealer positioning, and weather-regime context so traders see mispricings before the repricing.

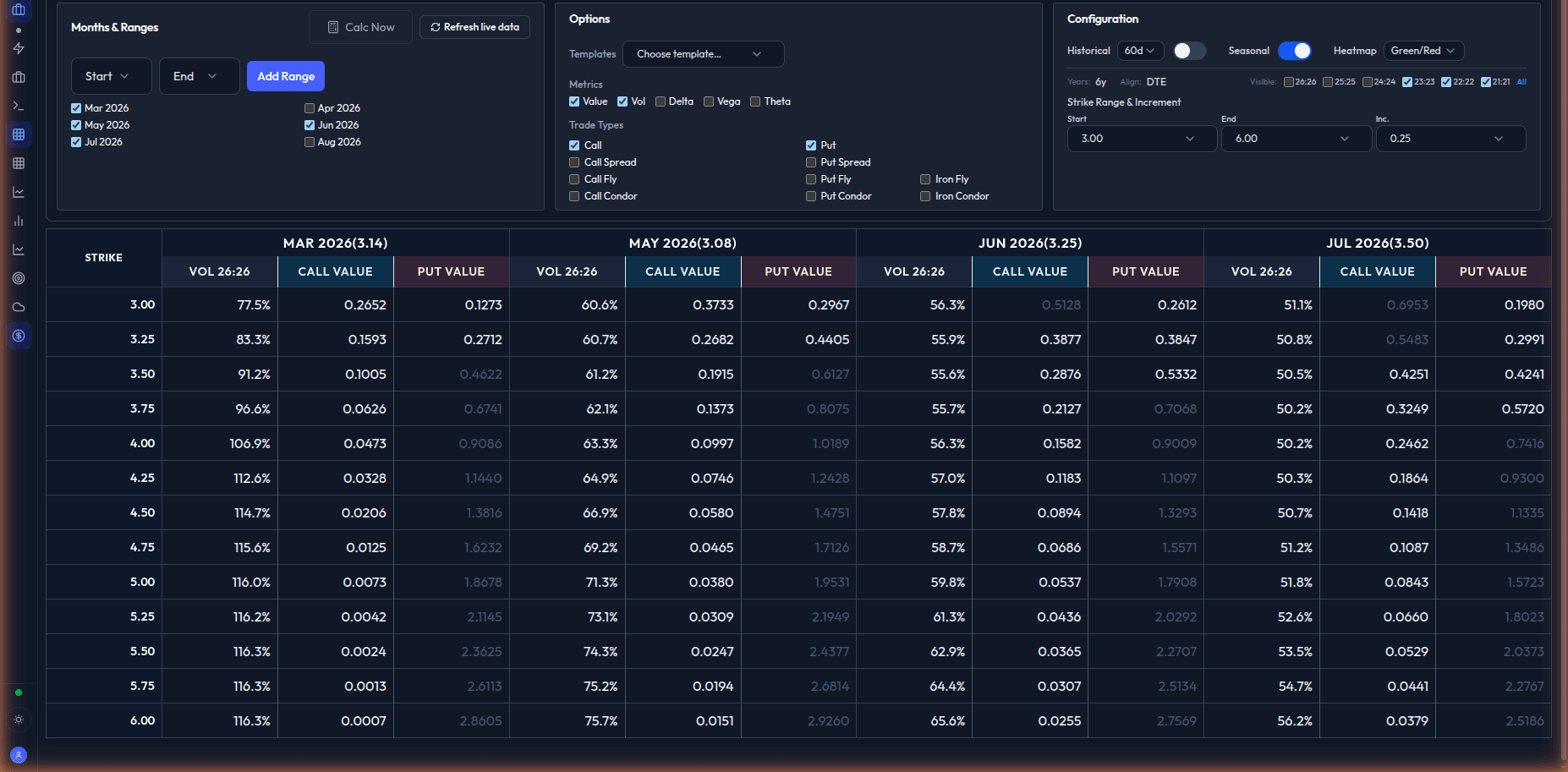

Live workspace view: vol structure, flow, and positioning in one screen.

Institutional Adoption

Used by dealer-bank desks, leading brokers, merchants & utilities, and multi-strategy trading firms active in energy derivatives.

Dozens of institutional organizations | Multi-desk energy options adoption

Client roster confidential. References available upon request (and under NDA where required).

Counts reflect active paid subscriptions in the last 12 months, measured by unique parent organization and/or desk. “Dealer banks” refers to regulated banking institutions operating derivatives desks; “brokers” refers to interdealer and commodity brokers facilitating institutional energy derivatives trading.

This is not an ETRM/CTRM system and not a generic options analytics bundle. It is the decision layer for institutional energy volatility desks.

Desks using end-of-day snapshots miss intraday skew dislocations. Real-time structure tracking closes that gap.

When dealer gamma concentrates at key strikes, hedge feedback loops can accelerate repricing. Know where exposure sits.

Regime shifts drive convexity spikes in NG and power. Map weather catalysts directly to vol surface impact.

Options matrix, spread scanner, flow feed, and weather overlays in a single surface built for energy vol desks.

Start with a live walkthrough, trade replay, or sample energy options report to see how flow, positioning, and weather regime context align before repricing.

Trade replays

Each replay documents the setup, flow, and structure shift so desks can assess what was visible and when.

NG's wild week - an 80+ cent sell-off, March vol crushed 32%, and the winter rally narrative gets tested. Free weekly market recap.

Market Overview Weather continued to add and market started talking about biggest draw ever and what price point we will need to fix it It seemed that $5.00 OI which was...

Market Overview And... just like that a 50 cent move Market is now running in scared, what ifs mode What if we get more weather with no SALTs or low SALTs No one wants...

Strike-specific options flow, volatility structure shifts, and trader-focused market intelligence.

NG's wild week - an 80+ cent sell-off, March vol crushed 32%, and the winter rally narrative gets tested. Free weekly...

Market Overview Weather continued to add and market started talking about biggest draw ever and what price point we...

Market Overview And... just like that a 50 cent move Market is now running in scared, what ifs mode What if we get more...

Trade the structure, not the narrative. This platform is built for faster visibility into energy volatility dislocations with actionable positioning context.

Vol intelligence workspace

Option matrix, spread matrix, flow scanner, and weather-regime overlays in one operating surface for institutional energy vol desks.

Map where gamma exposure is concentrated across strikes and expirations before hedge feedback loops accelerate.

Monitor term structure and skew changes as weather and flow shift, instead of waiting for end-of-day snapshots.

Filter block activity and recurring structures so you can separate true positioning from one-off noise.

Surface spread and strike mispricings with risk-reward context for decision-ready trade review.

Institutional readiness

Receive the same strike-level flow and volatility commentary used by active energy options traders.

Prefer to validate first? Start with a sample energy options report or book a live walkthrough.