Valor View – NG – Jun 25 – Andurand Losses & Energy Outlook

June 26, 2025

Market Overview & Breakevens

- Douglas is either an investor in Andurand or has a natural gas long vol, long delta position

- ANDURAND HEDGE FUND’S YTD LOSSES WORSEN TO 60%

- It's not been an easy ride for someone looking for that rally into the end of the month and especially with a long vol position

- We fell off 70 cents from Thursday highs and vol just can't stop taking a beating

- 3rd day in a row with low 50s for August now. That, Jan and Mar at 52 is also starting to look interesting

- Everyone keeps discussing "How low can breakevens go?" They are not happy with my answer that it can always go lower

- I guess, if we keep falling at some point BE becomes cheap enough to buy, but for now, the vol selling seems to indicate people have sort of faith in a floor nearby

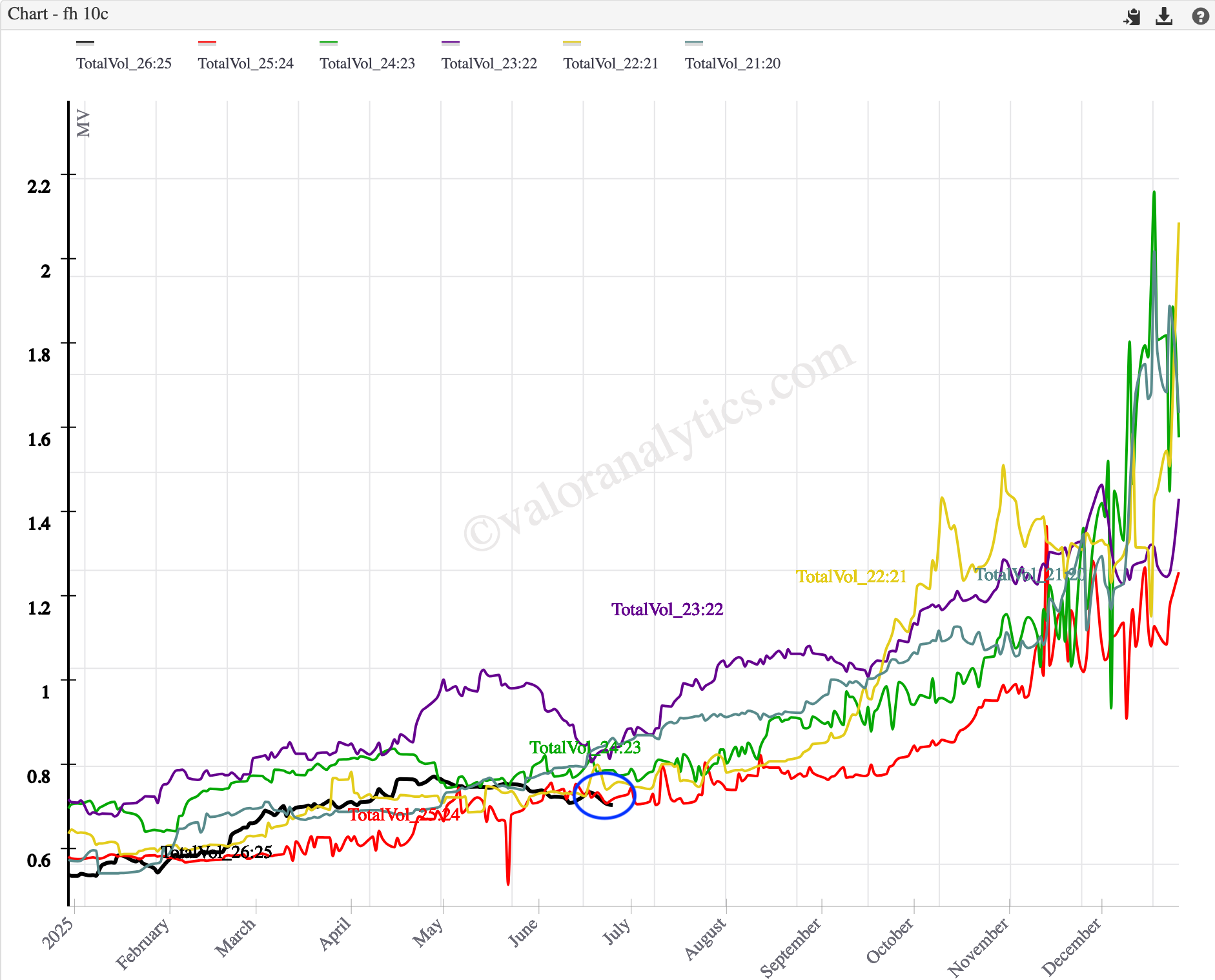

- Following chart shows Sep-Oct 10 delta put total vol and we are trading almost the lows seasonally

- Though it is not just on the puts, Q1 calls $10 call is now trading the lowest vol seasonally. It is still expensive vol wise than Feb, when we first highlighted it, but lowest seasonally

- Q1 $10 calls vol and value also just keeps going down. It is almost within few cents from the values back in Feb

Vol & Sentiment

- All of the Q1 vol gains from liberation day are gone now

- Bears are frustrated with put vol not going up, bulls are frustrated with calls getting hit

- Winter fences are still getting hit

- People still seem to be getting out of Q1 call positions vs puts

- Traders are buying V $2 handle put spreads in size

- The only bullish interest there is, is still in Summer '26, but that too not outright but as call spreads, traders don't realize but they are being made to pay for the call spreads

J26 5.00/6.00cs traded 0.133

JV26 5.25/6.00 call spread traded 0.1125 - Many just want something cheap on the books. They want something in the $9/$10 range, but won't pay an extra penny to just buy it outright

Cal26 2.25/2.00ps vs 9.00/10.00cs traded 0.011

Key Trades

- X25H26 3.00/5.50 fence traded 0.347 (selling call, buying put)

- FH26 7.00/10.00cs vs. 3.75p traded 0.111 (selling call spread)

CSO & Spread Flow

- I took a little bit of the Q1 action today, buying Jan 7.00 (60 vols) calls vs 4.00 puts (50 vols) for 5 cents. They are liquid enough on the screen now

- Aug 4.00/4.50/5.00 call fly is down to almost 4 cents

- With 3.9++ EoS, it is hard to be bullish anything in the front, but if cash can shake off this weakness and we can get some withdrawals, we can get a small pop

- Cash can't seem to find any legs and weather outlook doesn't look great either, but it is hard to give up on summer right before it starts

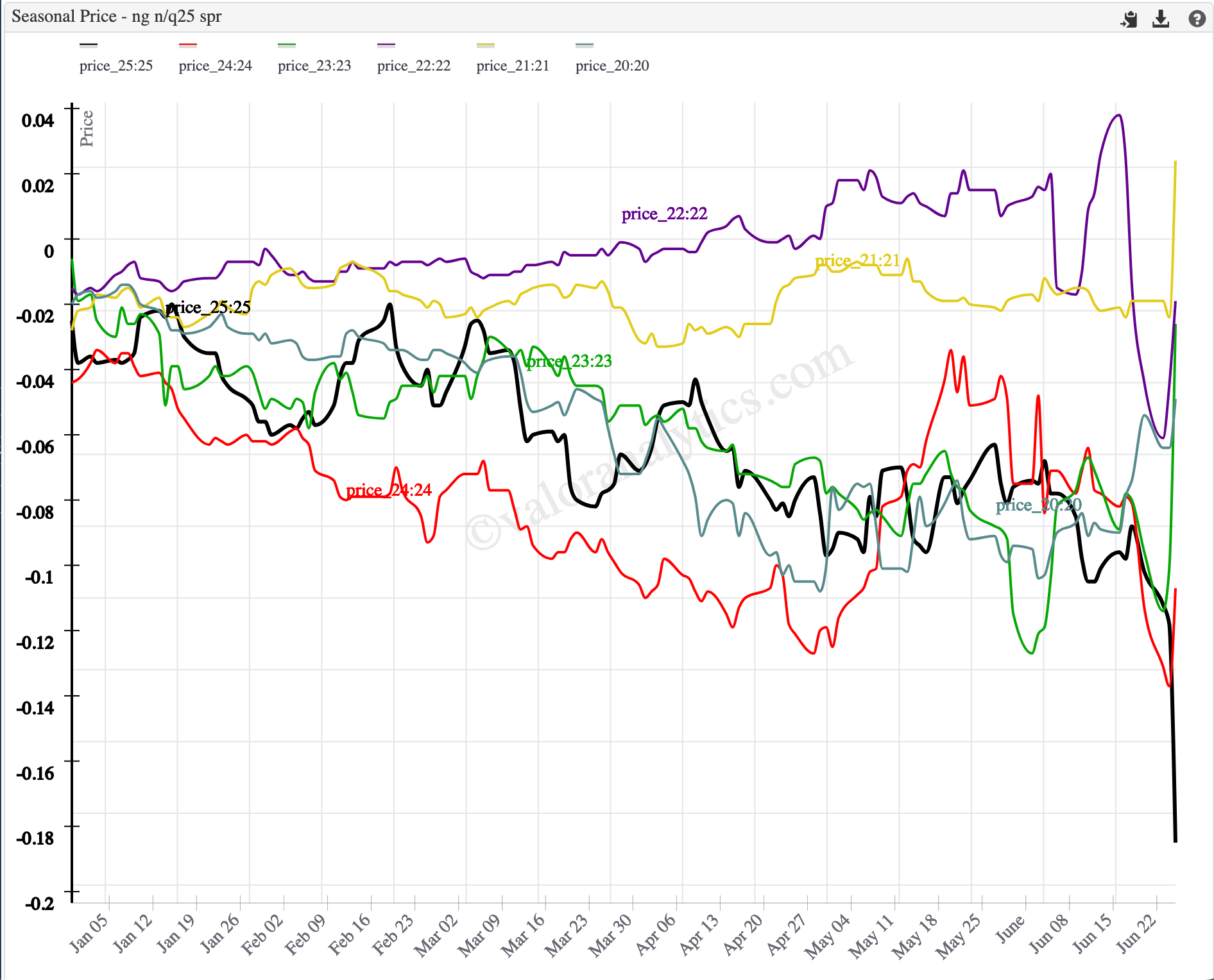

- N/Q widened to 18+ cents, something almost never seen, causing a lot of pain

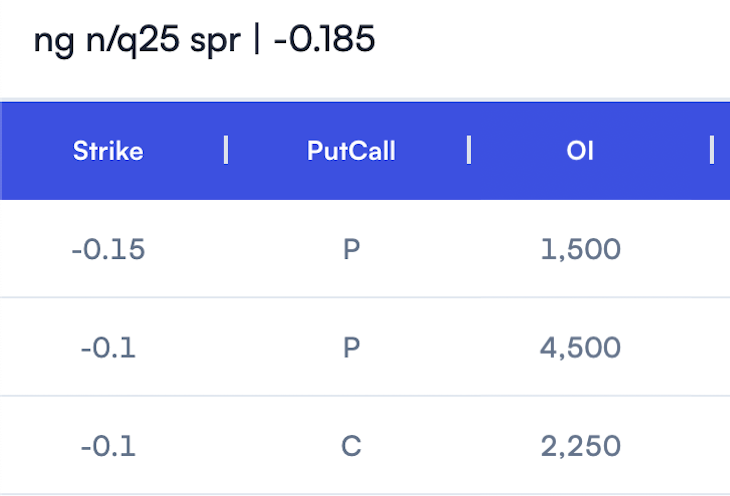

- Price and spread just collapsed into the close and I am pretty sure N/Q and N/V CSOs were involved. There was Open Interest on N/V CSO all the way from -0.15 puts to -0.25 put as the spread went from -0.12 to -0.302 in a week and into Option Expiry

- N/Q also had OI on -0.10 puts and -0.15 puts and clearly the N/Q move today wasn't just about cash as the -0.15 puts went into the money on Opex

Disclaimer: This content is published by Valor Analytics LLC and is for informational purposes only. It does not constitute investment advice, a trade recommendation, or a solicitation to buy or sell any securities or derivatives. Trading in energy derivatives involves substantial risk of loss and is not suitable for all investors. You should not make any investment decisions based solely on the information presented here. Valor Analytics LLC and its authors may hold positions in the instruments discussed. Any references to past price movements, trade outcomes, or market scenarios are not indicative of future results and may reflect hypothetical or illustrative examples. Please consult a qualified financial advisor before making any trading or investment decisions. By reading this content, you agree to our Terms & Conditions.