Valor View – NG – Jul 29 – August Expiry & Cal '26 Weakness

July 29, 2025

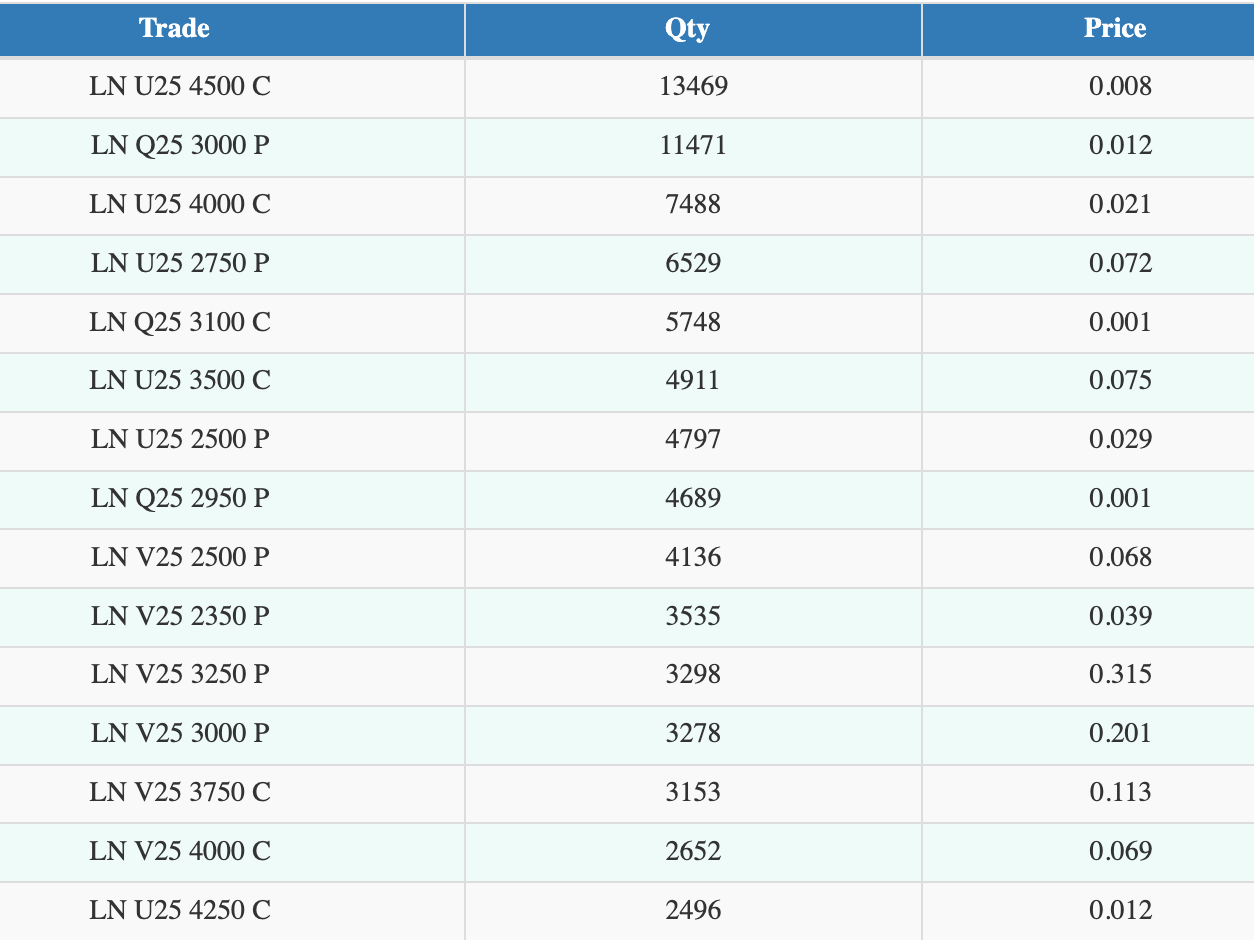

Opex & Market Overview

- Monday had two things going. August expiry which pinned it towards the $3.00 strike and some deal in the back which saw everything getting hit in the backs

- Cal '26 was almost 10 cents down before recovering later in the day

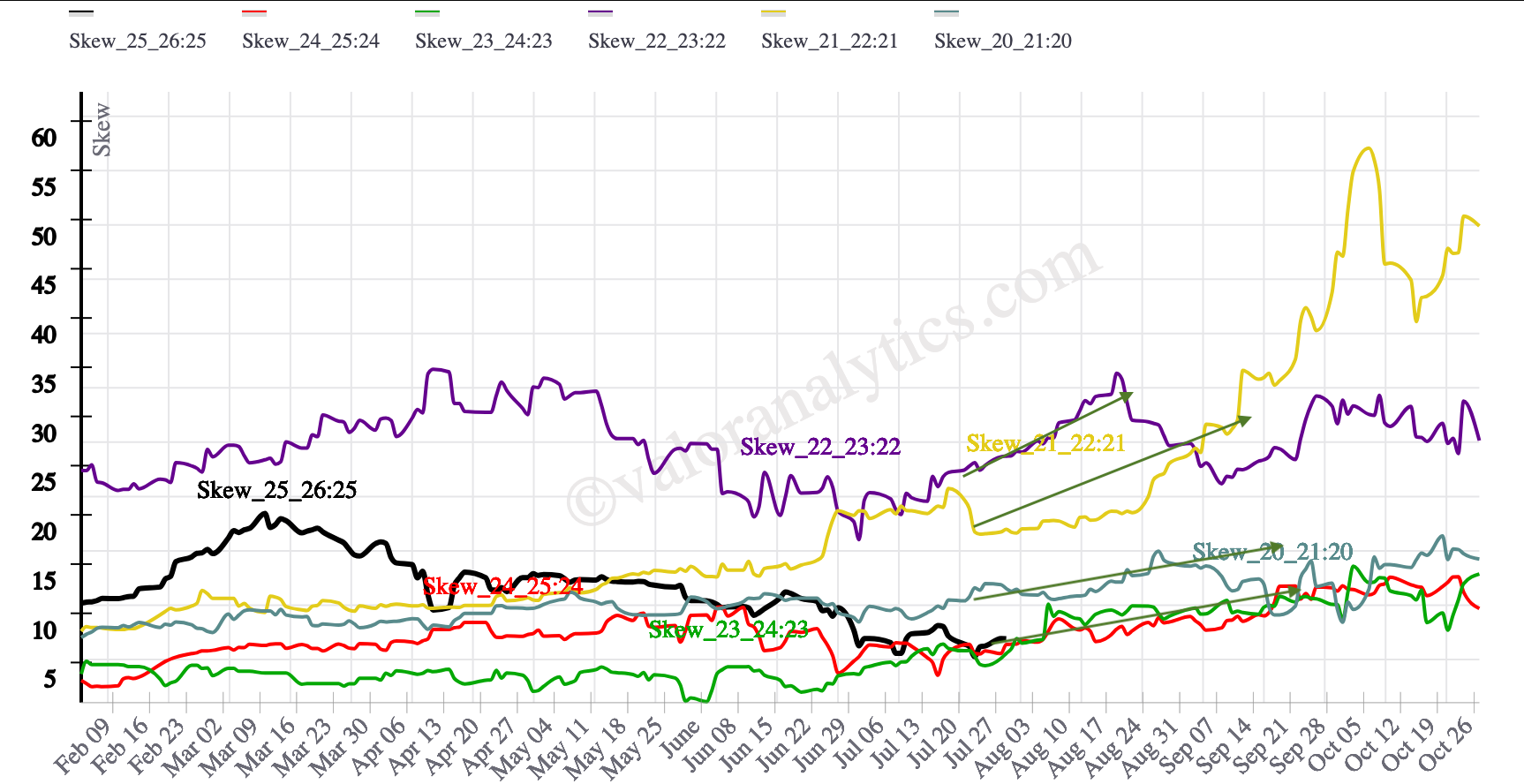

- This latest move down was accompanied with put selling and getting long delta through at least Cal '26, leading to put skew being down everywhere as can be seen below

- Skew was possibly higher in U calls as U 4.50 calls were the highest traded volume on the screen, possibly covering the shorts for few tics

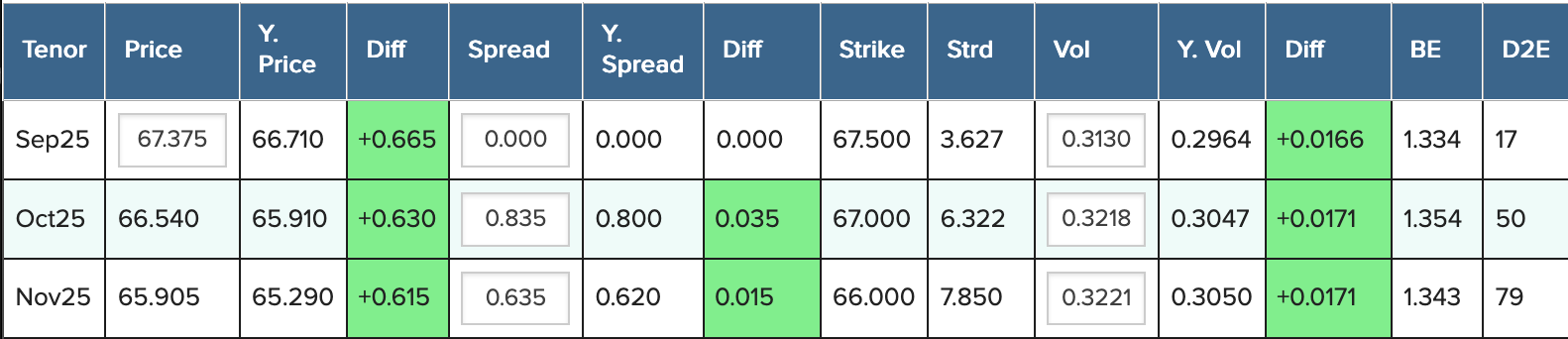

Price & Spread Analysis

- People even resorted to 1x3 put spreads

- Jan 3.50/3.00 1x3 put spread 0.042 (collect). This trade is long about 10 delta

- Feb 3.50/3.00 1x3 put spread traded 0.135 (collect). This trade is long about 20 delta

- So, people took advantage of the sell off by selling puts

- The trades can make 54 to 64 cents respectively if we pin the expiry at 3.00 (just like Aug)

- With the sharp move down in '26 and Apr 26 below $3.50 for a while, it seemed like traders took profits

- JV26 3.25/2.75 ps got sold for 16 cents

- Sep 3.00/2.75/2.50 put fly got hit for 0.042

- The new bearish trades seemed to be mostly teenies

- XH 2.00/1.50 1x2 ps traded 0.006

- U/V -0.15/-0.20 1x2 ps cso trade 0.001, looking at a settle between -0.15 and -0.25, possibly pinning -0.20

CSO & Calendar Spreads

- Speaking of CSOs, I think once again the CSO strikes came into play with the curve almost down flat, Q/U widened sharply during the day with -0.05 put coming into play

- For reference, U/V has OI all the way -0.05 to -0.20 put

- Someone betting on U/V going to -0.20 is still bearish the front, we seemed to have bounced off the $3.00 strike though for now

- Aug moved from that rally to 3.80 to 3.00 and V/F widening only about 10 cents which shows you how many market participants shifted to selling higher priced winter and Cal '26 rather than the front

- Production is already at the highs and the rig count increases is not helping either

- E.g. Paloma Energy went from 0 rigs at start of 2025 to 5 rigs in Q2, their full deployment

Vol & Hedging

- Looks, like the smart people have been aggressively hedging Cal'26 ever since that short rally few days back when Jan refused to go over $5.00

- Increasingly, for the producers, it will be a game of what comes first, the rigs or the "hedges"

- I was looking at the winter (XH) skew and almost every year, it bottoms out around this time period

- Not sure if these production levels and high EoS and increasing rig counts is making anyone bullish at the moment though

Crude & Outlook

- Crude rallied as the Commander-in-chief has changed the deadline from 50 days to 10-12 days now Aug 7-9th, buy vol ahead of it?

- People are already on to that trade with vol roofing again. Now, the next trade in early Aug will depend on if you believe in TACO or FAFO trade

- Unfortunately, that's the kind of kick-ass analysis that moves the market these days

- Also, Shweta is going to be aggressively long her 1 lot position on a 2-3% drop in natural gas. Not sure, if it better or worse than your in-house analysis

- The in-house analysts at many places haven't done good so far this year. Not sure if the following will be true in bonus week

Disclaimer: This content is published by Valor Analytics LLC and is for informational purposes only. It does not constitute investment advice, a trade recommendation, or a solicitation to buy or sell any securities or derivatives. Trading in energy derivatives involves substantial risk of loss and is not suitable for all investors. You should not make any investment decisions based solely on the information presented here. Valor Analytics LLC and its authors may hold positions in the instruments discussed. Any references to past price movements, trade outcomes, or market scenarios are not indicative of future results and may reflect hypothetical or illustrative examples. Please consult a qualified financial advisor before making any trading or investment decisions. By reading this content, you agree to our Terms & Conditions.