Valor View – NG – Aug 27 – Opex Vol Crush & Straddle Collapse

August 27, 2025

Opex Review

- I think what Opex would bring was clear on Friday itself, when vol got smashed bringing the straddle down to 12 cents with a weekend and 2 business days still out there

- Whoever, did the smashing made money on that 12 cent straddle as well

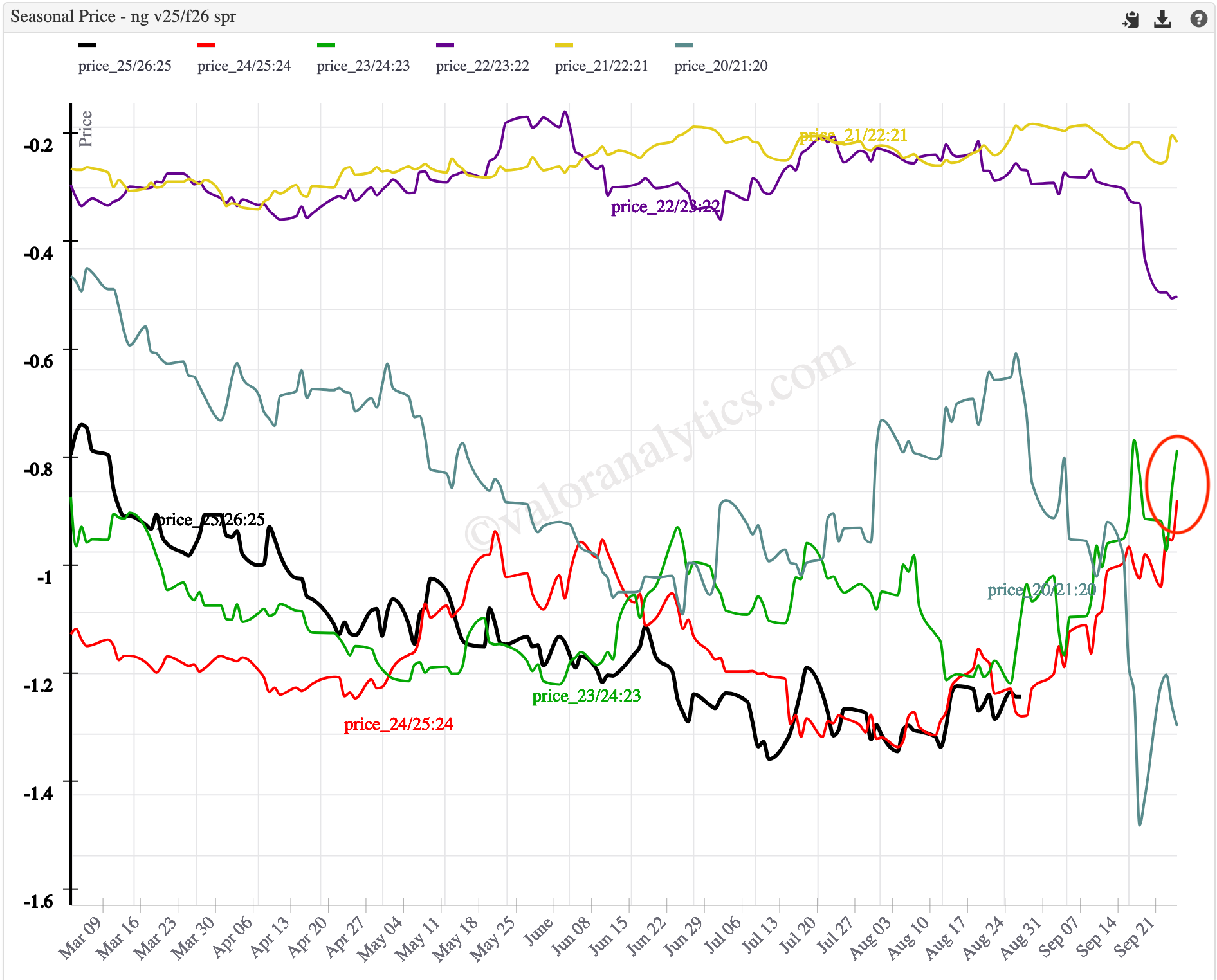

- Lately, all of the moves have mostly become about V/F and I have been wondering what is happening

- My initial theory was that with BON retiring and the other market maker not having a big size, we may see some fireworks into V/F expiry

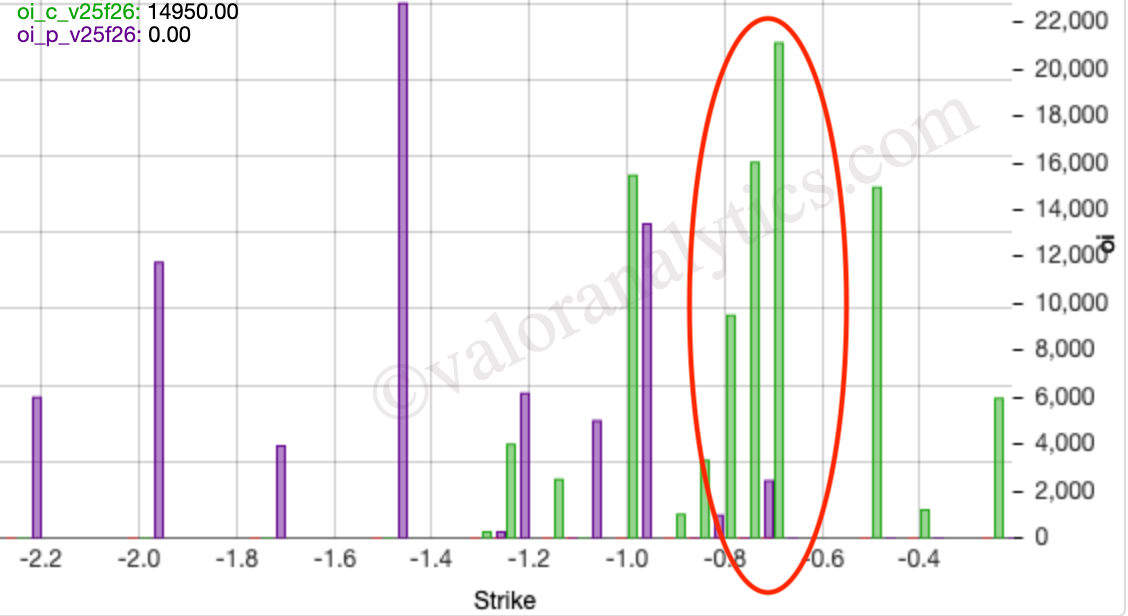

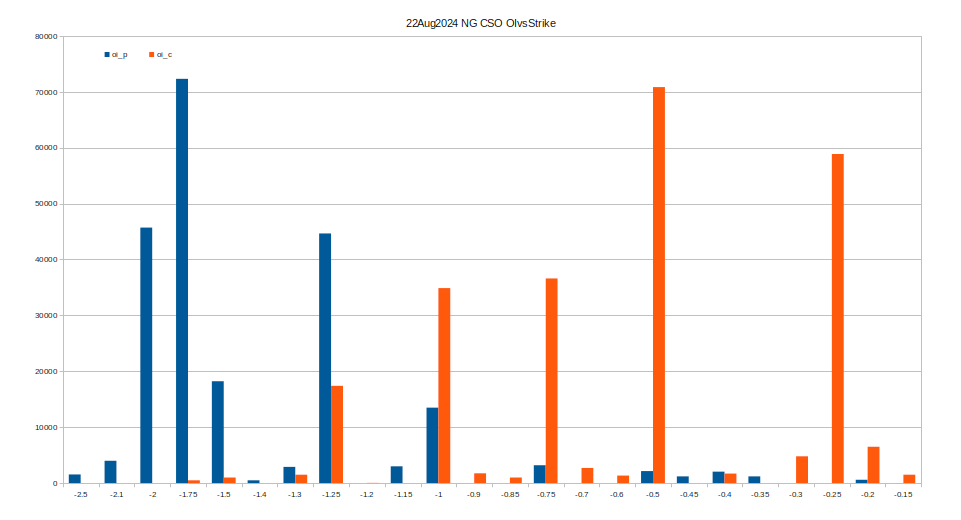

- But, what if the stress is already present. Without proper delta hedging, this -0.75/-0.85 area is the worst for market maker(s)

Settlement & OI

- And this is right where we have been settling for last two years. So, any decent risk manager at a FCM would flag these positions and force over hedging etc through margin increase

Skew & Vol

- So, all these theories about spec being short winter etc may have a simpler but deadlier explanation of V/F CSO hedging

- As V/F becomes less and less liquid, the moves will be even more volatile going into expiry

- The OI last year was much much higher, but it was much cleaner and the market makers were at bigger shops

- This is the only way I can explain V/F contracting on down moves, other than the theory that it's so bearish that people want to sell more winter premiums than the front

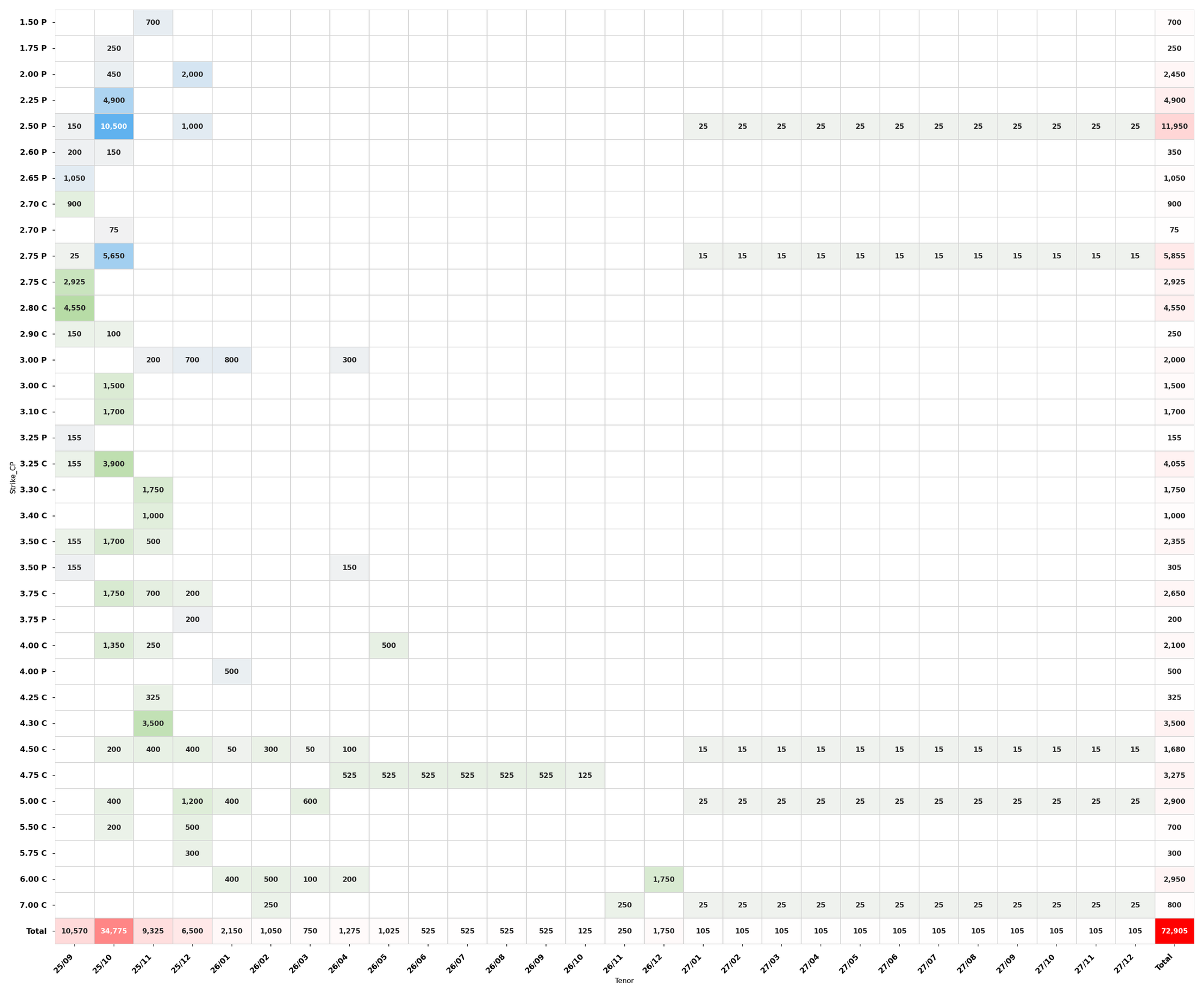

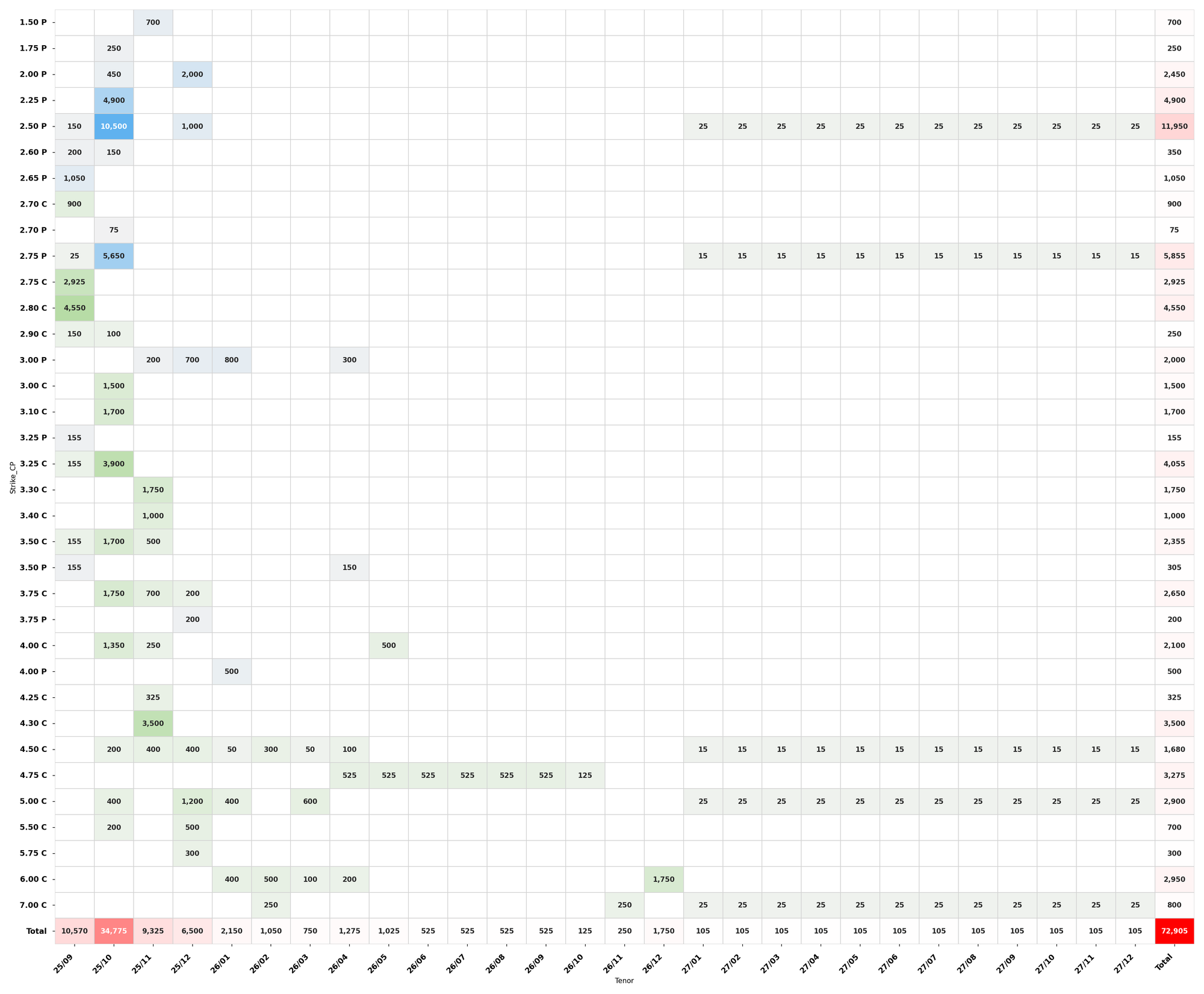

Key Trades

- People who had sold Q4 and Q1 winter premium are not stupid

- I see live calls being bought now, potentially covering the shorts

- Smart people cover when they get away with stupid trades, otherwise you risk becoming optionsellers.com

- Q1 6.00 calls were lifted for 16.8 cents

- Sumer'26 2.50/4.50 fences were bought for 19 and 19.3 cents lifting the calls

- People seem to be taking profits on this move down as well

- V 2.50 put got sold for 0.071

- X 3.00/2.50/2.00 put fly got hit 0.105

- Someone, even paid few tics for V 3.60/3.75 cs, bet or hedge against V/F?

- With weather and production levels what it is, a rally seems unlikely, but prudent people are at least taking profits/increasing length on Q1 and JV26

- With last EIAs bullish miss, people will be intently looking for signals if there is phantom production or not in the data

Outlook

- Profits were taken on V 2.75/2.50/2.25 put as well

- Let's hope for a better future expiry than the option expiry that we just witnessed

Disclaimer: This content is published by Valor Analytics LLC and is for informational purposes only. It does not constitute investment advice, a trade recommendation, or a solicitation to buy or sell any securities or derivatives. Trading in energy derivatives involves substantial risk of loss and is not suitable for all investors. You should not make any investment decisions based solely on the information presented here. Valor Analytics LLC and its authors may hold positions in the instruments discussed. Any references to past price movements, trade outcomes, or market scenarios are not indicative of future results and may reflect hypothetical or illustrative examples. Please consult a qualified financial advisor before making any trading or investment decisions. By reading this content, you agree to our Terms & Conditions.