Valor View – NG – Oct 31 – Market Sentiment & Product Launch

October 31, 2025

Product Updates

- Had a good month on the product launches as well. Option Matrix is looking awesome

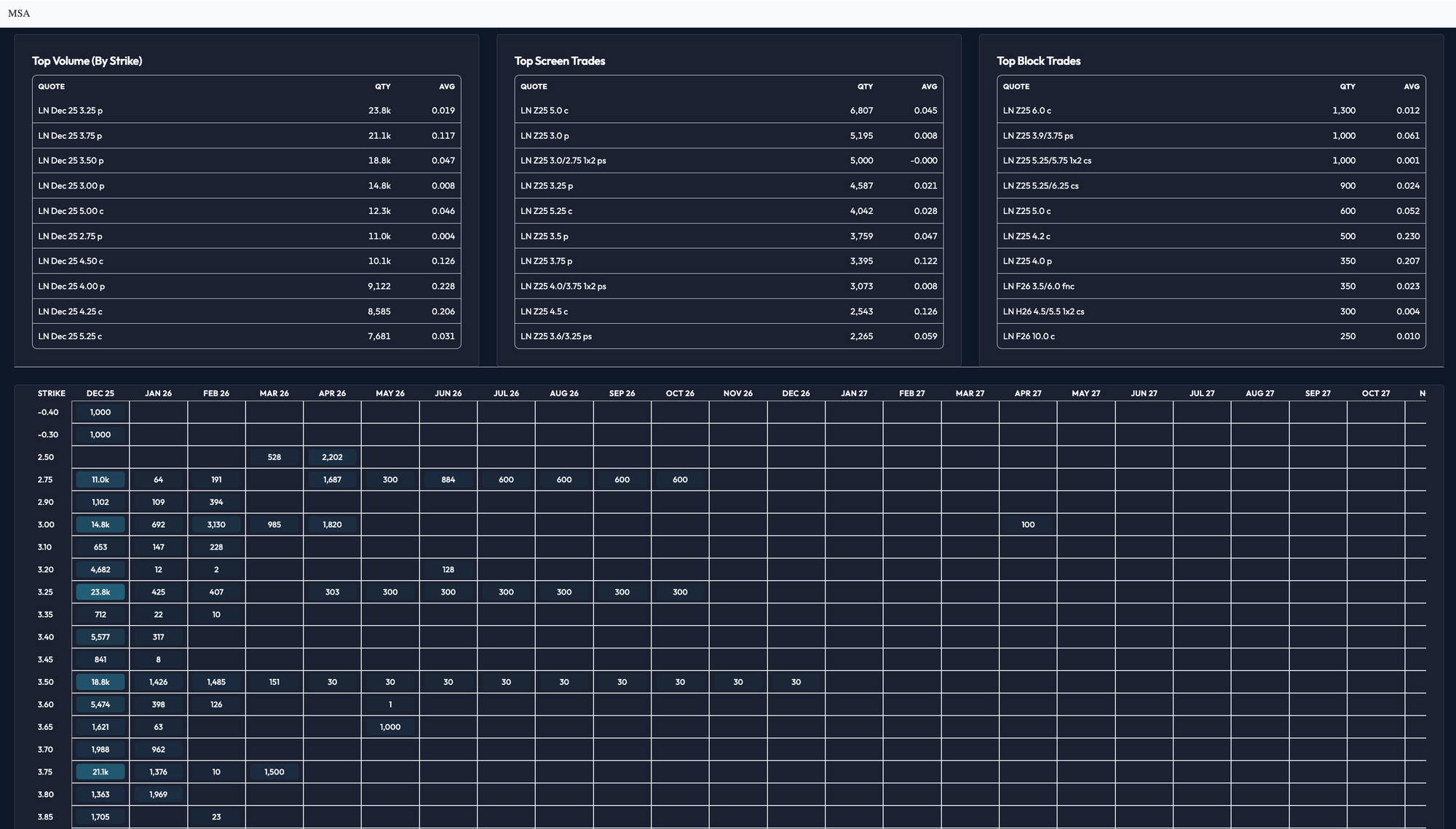

- Market Sentiment (MSA) page is looking pretty good as well

- Click OM or MSA on the left panel

- In the next few weeks, once the AI Agent Chat is active. It is going to be pretty sweet. Currently, the model is pretty sophisticated, but it is not easy to use the first time. My goal is to make the information and analysis accessible to everyone. Hope you have as much fun using it, as I am having building it. Stay Tuned

Market & Skew

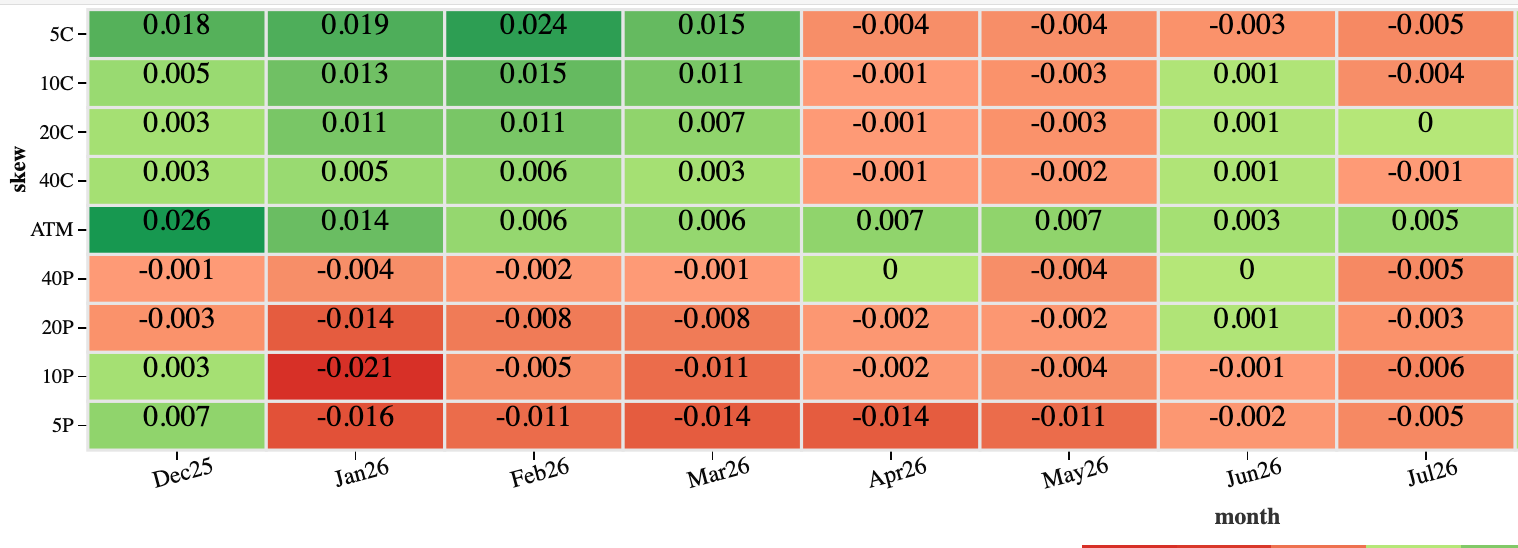

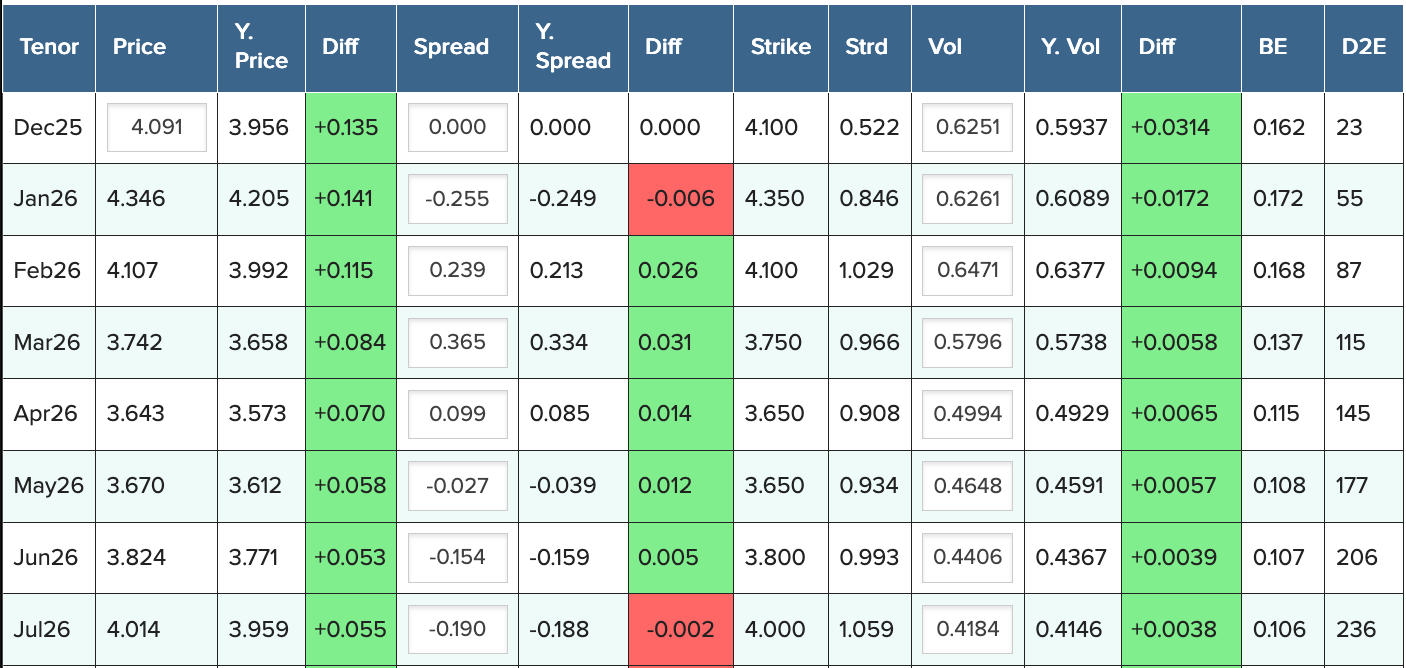

- Coming back to the markets. Q1 skew moved rightly to the calls and puts lost interest

Volume Analysis

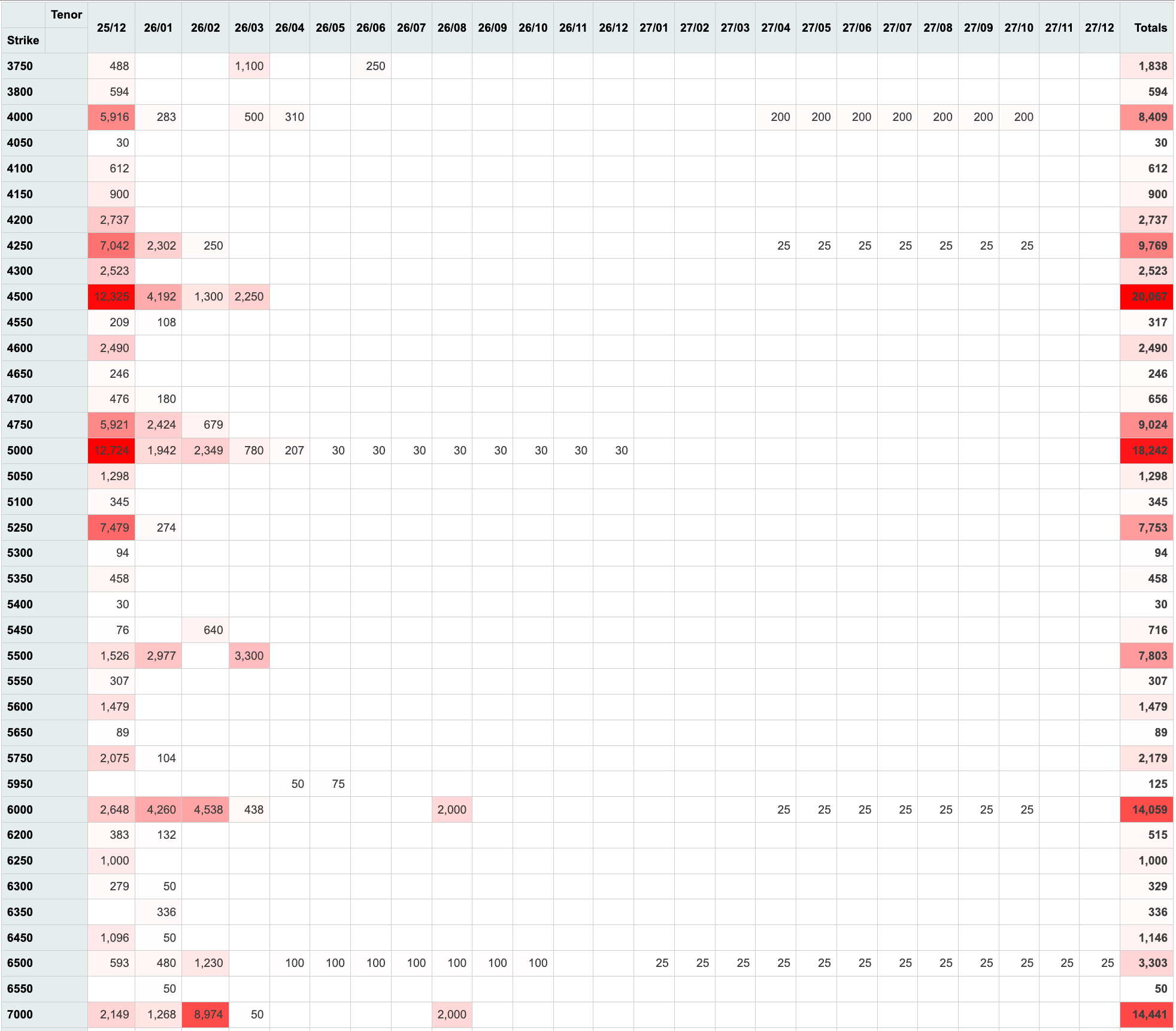

- Put volumes are still outweighing the calls 2:1

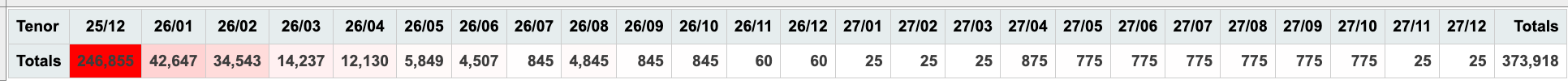

- December puts were super active. CME is very very happy. Almost 250k contracts traded just on Dec

- Put volumes

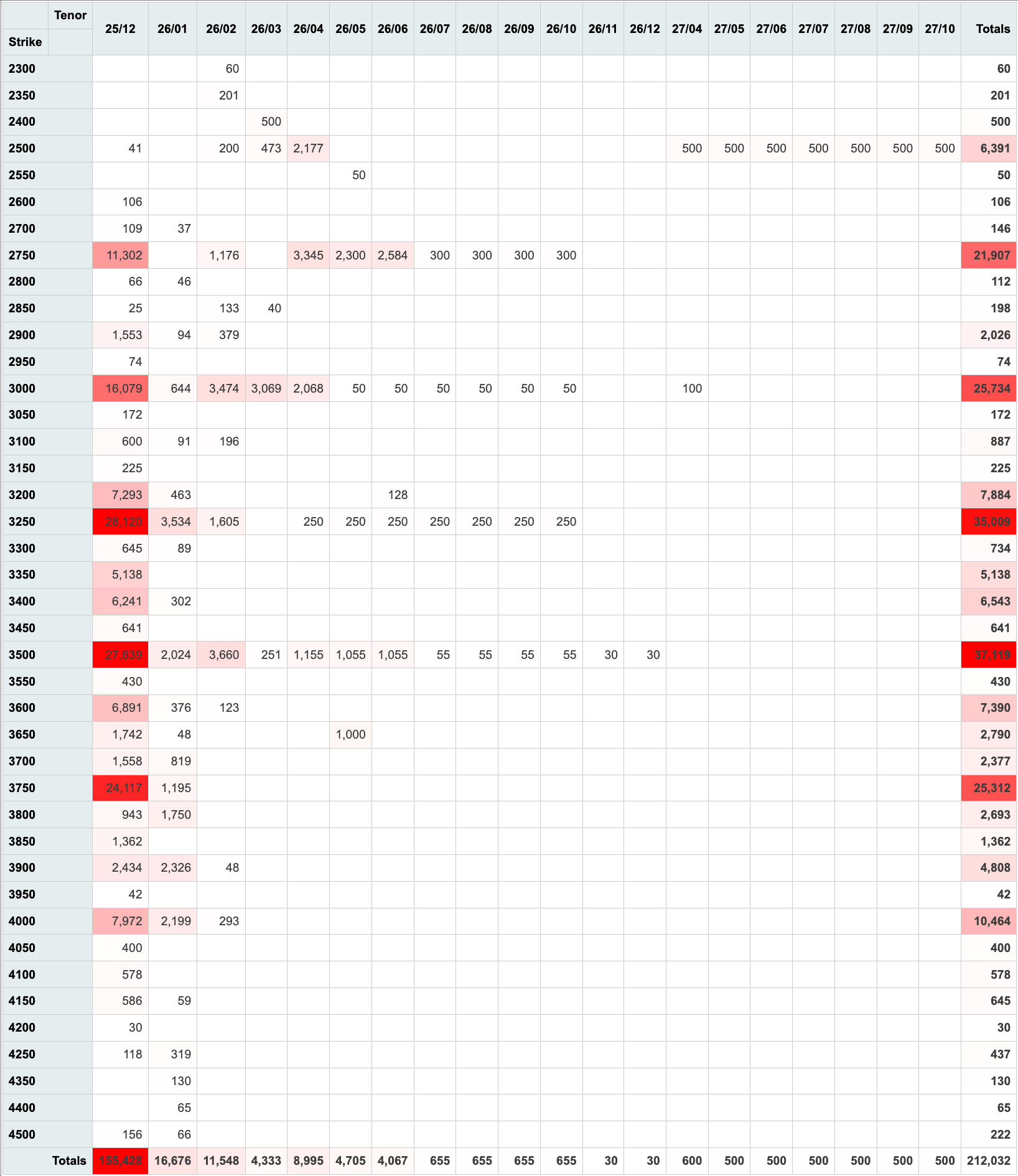

- Call volumes

Flow & Trades

- Skew went bid, but flow wise, options market is trying to take advantage of this week 6 cold induced rally

- Dec 3.5/3.25/3.00/2.75 put condor traded 2 cents for good size

- Dec 4.50 calls got hit 12.2c live

- Jan 3.5/5.50 ITM call spread got hit 93.8 cents

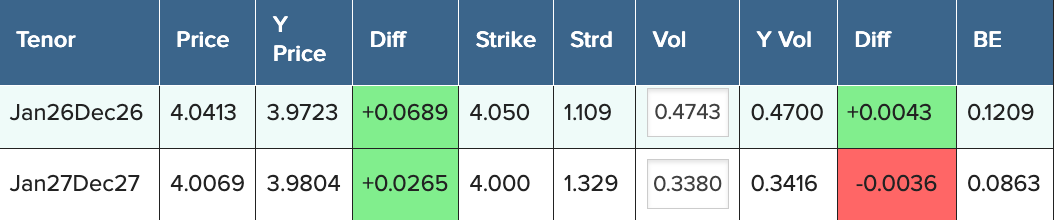

- Front vol rallied in Natural Gas, but Cal '27 got hit

Outlook

- I suspect it is related to power trading as Cal '27 1x vol rallied 2 vols on 1x 75.00 calls trading 5.25

- Have a good weekend. We have a potential for a 25c move either way depending on how weekend weather and production performs. Production could remain dicey for few days with first of the month issues and Tuesday

- Let me know if you have any questions

- ** Past performance does not guarantee future results. The value of investments can fluctuate — you may gain or lose money. Market conditions, economic changes, and global events can all affect investment outcomes.

Graphs and illustrations are for educational and informational purposes only and should not be your only basis for making decisions. Every investment carries risk — including potential loss of principal