Valor View – NG – Nov 4 – Valor AGI Weather & Demand Outlook

November 5, 2025

- Valor AGI (AI Generated Intelligence)

Weather / Demand Outlook

Short-range forecasts indicate a modest uptick in cold risk across the central and eastern U.S. heading into mid-November, particularly between the 9th and 13th.

However, the broader 6- to 14-day pattern still shows near- to above-normal temperatures across much of the South and West. Heating-degree-day totals are improving slightly but remain uneven, with national demand likely to stay below normal before trending closer to seasonal averages if the cooler pattern holds.

The Midwest and Northeast are expected to see the most incremental heating load gains, while the South-Central region remains mild. Overall, the market is watching whether these colder anomalies expand and persist into late November before re-rating demand higher.

Price Action & Market Structure

Front-month futures have extended their rally into the low-$4 range, supported by cooler model runs and steady export demand. Prices have encountered resistance near $4.40–$4.50 while holding support around $4.10–$4.20. The Dec–Jan spread remains firm around +$0.23, reflecting a modest winter premium but no structural stress

The curve continues to show mild contango through the winter months, suggesting expectations for stable supply and adequate inventories. Momentum remains constructive but highly sensitive to day-to-day weather revisions.

Trader Tone & Sentiment

Sentiment is cautiously bullish. Traders are encouraged by incremental heating demand and resilient LNG feedgas flows, yet remain aware of strong production levels—estimated near 110 Bcf/d—and above-average storage.

The prevailing strategy is tactical: buying dips on cold model confirmation but fading sharp rallies until temperatures deliver sustained verification. Hedging activity among producers remains moderate, reflecting comfort with current price levels and balanced market conditions.

News Highlights

- U.S. LNG exports set a new record in October, with strong European and Asian demand anchoring feedgas flows near multi-month highs.

- LNG shipping rates have climbed to seasonal peaks, reflecting tightening vessel supply and pre-winter restocking activity.

- U.S. underground storage sits near 3.88 Tcf, roughly 5 percent above the five-year average, reinforcing a comfortable supply backdrop even as winter approaches.

- Power-sector gas consumption has softened with elevated wind generation, partially offsetting gains in residential and commercial heating demand.

Bottom Line

Natural gas prices are consolidating around the low-$4 range, buoyed by cooler forecasts and export strength but capped by robust production and ample storage.

Traders remain weather-driven: a deeper, more persistent cold pattern or a supply disruption would be required to push prices decisively higher. Until then, range-bound trading with a modest upside bias is the most probable path.

Sources: X, Reuters, Barchart, Natural Gas Intel, Investing.com, CME Group, NOAA CPC, EIA

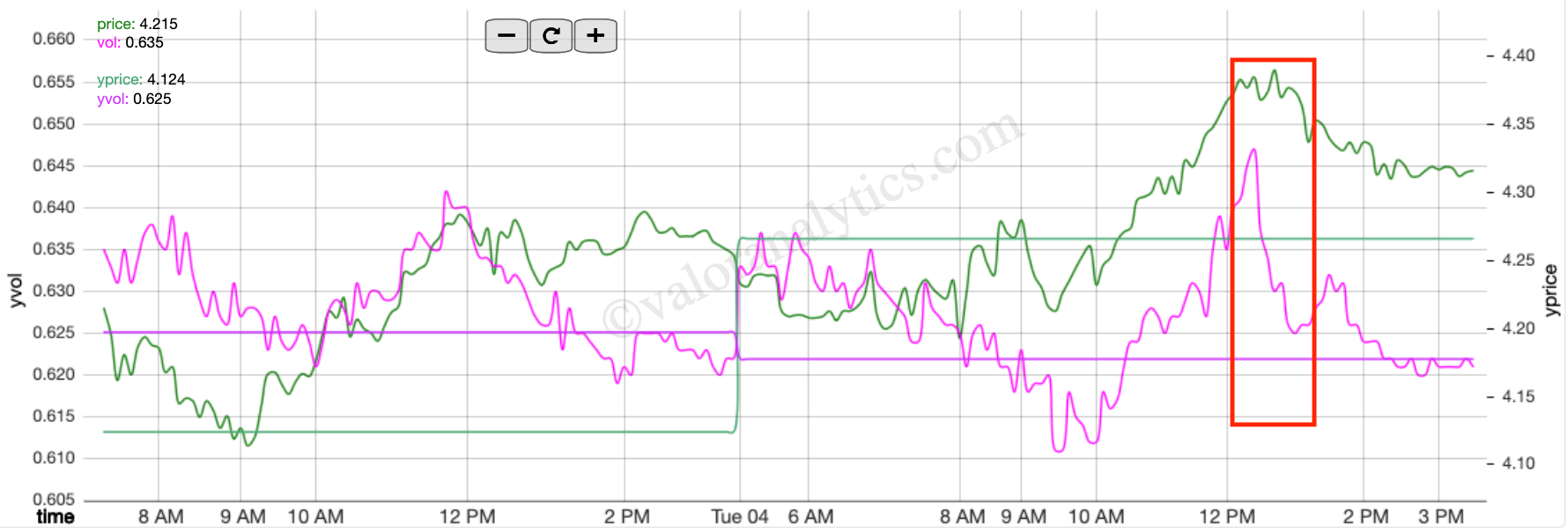

- That was not bad, considering that I don't have much clue what intraday action is about, other than the weather runs

- Market ignored cash again. Ignored increased production guidance from vendors

- There was some craziness in power (PJM) as well with futs and vol roofing and I wonder if it led to the initial move higher

- Hyper focused on Dec cold for now and the 2 day cold event in Nov. Early cold always has the biggest impact

- BUT, what did the market spend time and money on? Asking themselves, what if cold doesn't show up

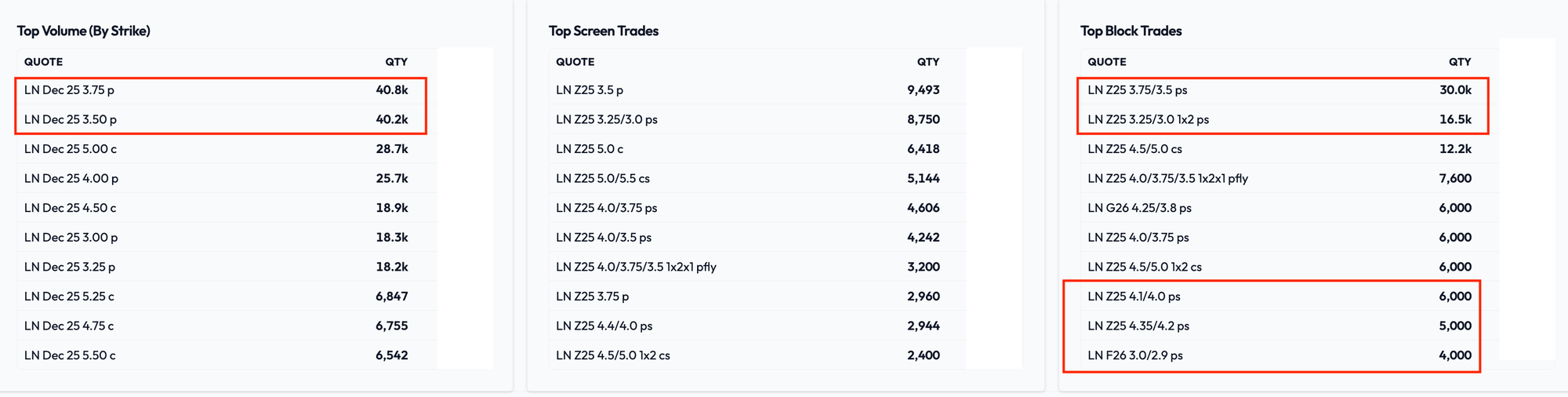

- The morning was slow, but by afternoon full Dec put party was on

Dec 3.75/3.50 put spread for 3-3.5c

Dec 4.35/4.20 put spread traded 7.55c

Dec 4.10/4.00 put spread traded around 3.55~

Dec 4.00/3.75/3.50 put fly traded 3c ~

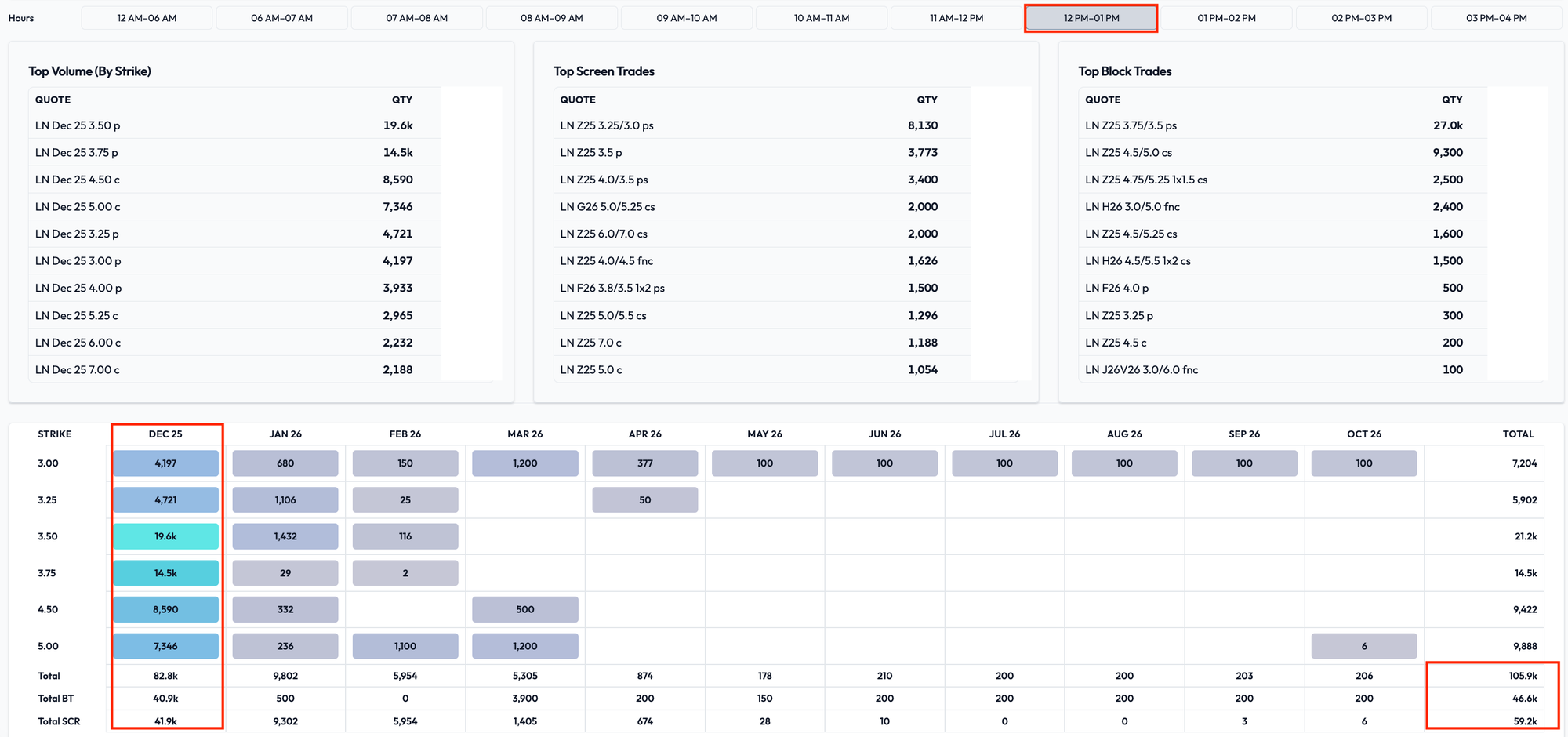

- 12 noon to 1 PM was the busiest hour, exchanging over 100k contracts on CME

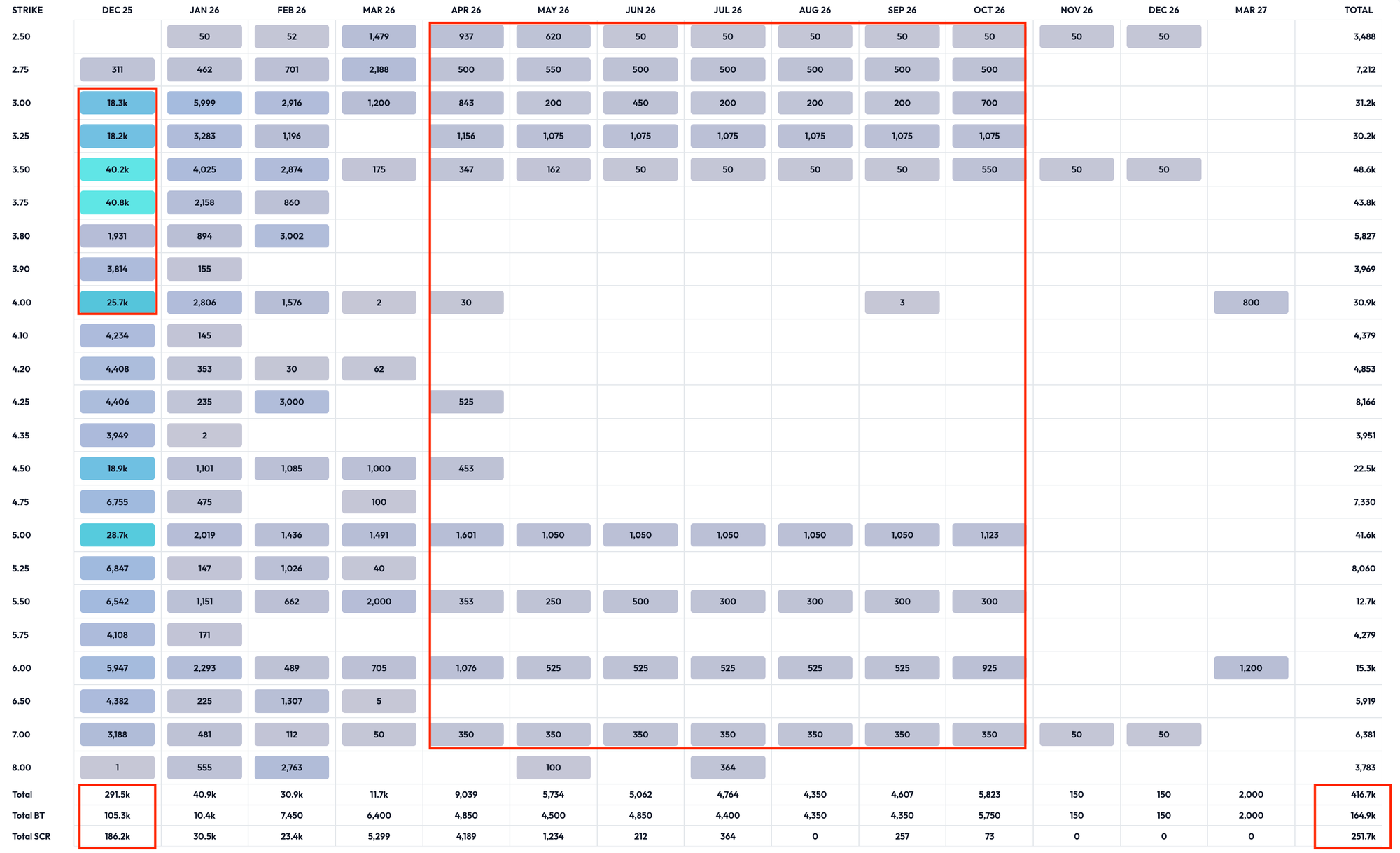

- Overall, happiest entity right now is CME with over 400k contracts going through today, when initially for a moment it looked like it will be a slow day

- Almost 300k contracts just in Dec

- Summer was also active with fences

- Other than thinking about what if the cold doesn't show up, market also spent money on Summer trades

- JV 3.75/3.25 1x2 ps traded 1.5c

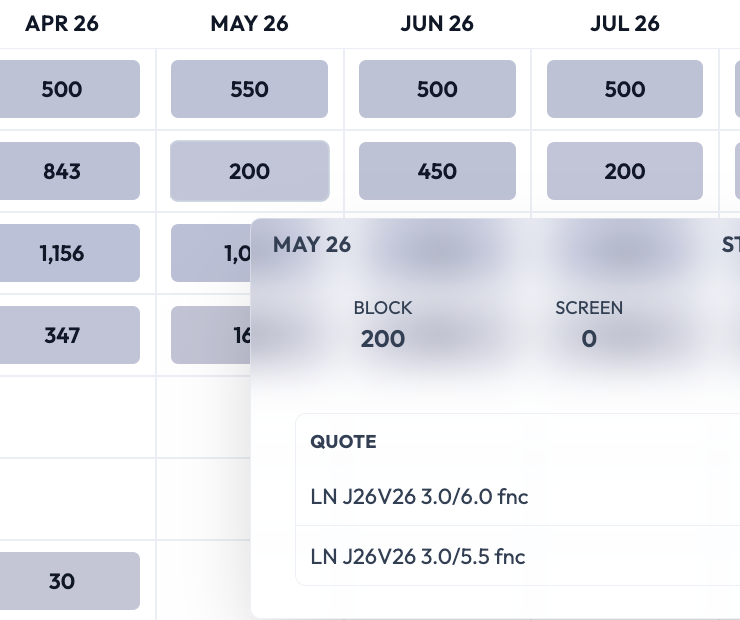

- JV fences were also active. You can hover over the strikes on MSA to see what trades was it part of. It is under active development so please bear with me for few days

- Producer style fences always get active around $4.00 futs

- But, what is also happening is with the production guidance being increased higher, many are raising their V26 EoS and those trades were active as well

- Oct 3.50/3.00 ps traded 15.7c

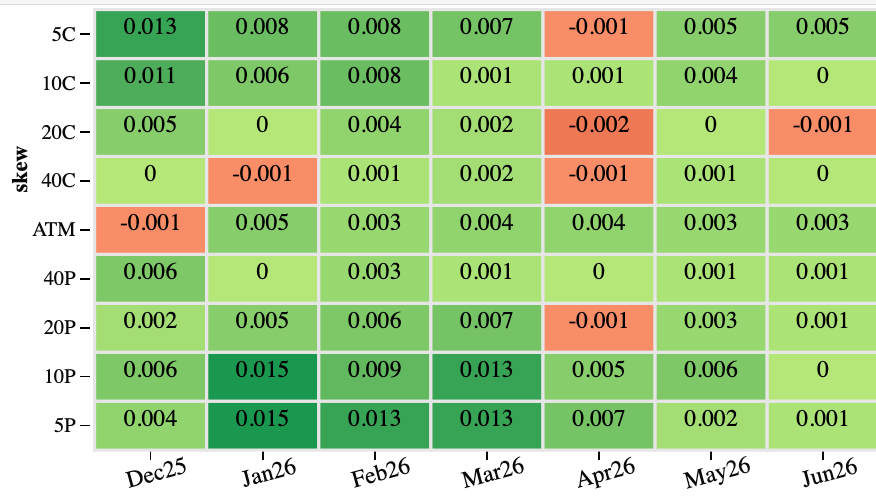

- Vol went lower for the day early in the morning during the slow period, but we rallied 4 vols going into afternoon along with futs

- This 12-1pm was the most active period where at least front vol got smashed along with buying of those put spreads

- Dec 3.50 puts traded down to 2 cents. I also bought back some of those strikes, but I felt so bad paying 65 vols for them, but better to cover them at these prices esp. if one was short

- Vol was mostly green across puts and calls. Market is trying to buy everything at this point

- People have been wondering what happened to all those Dec 4.50 calls

- First thing, the trade was hedged. Even, if you don't buy any more delta on the way up, it is still up money

- This is the trade history of -1 z 4.5c; 0.2 z25 f

- Short Dec 4.5 calls hedged with 20 delta

- The first red circle is when the trade was put on. It was up about 4 cents till 2 days ago and still up 2 cents

- And, if one hedged the whole way up, it made much more money

- But, looking at OI, it feels to me most of it is off already

- The pain would have come as we crossed 4.50, but that was not to happen. At least not today

- Let me know if you have any questions