Natural Gas Weekly Recap: The Weather Rug Pull & Vol Aftermath | Feb 1-5, 2026

NG's wild week - an 80+ cent sell-off, March vol crushed 32%, and the winter rally narrative gets tested. Free weekly market recap.

Energy options intelligence for institutional desks

Real-time options flow, dealer positioning, and weather-driven vol shifts for NG, CL, and HO.

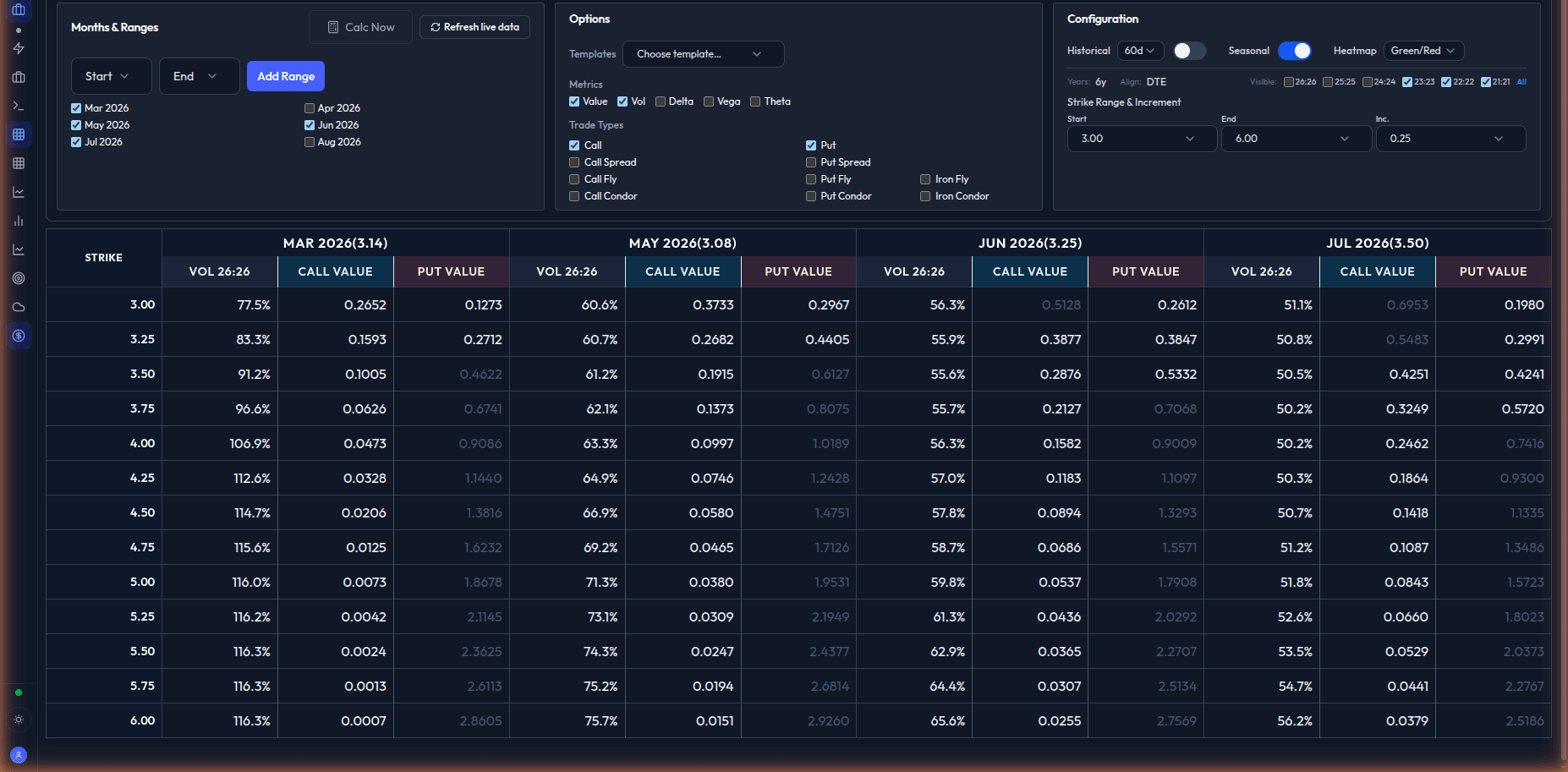

Live workspace view: vol structure, flow, and positioning in one screen.

Institutional credibility

10+

Years in energy derivatives

Intraday

Flow and vol monitoring

Daily

Desk-ready market commentary

NG / CL / HO

Core options coverage

Flow, skew, and vol-surface shifts designed for active desk monitoring.

Energy options coverage built specifically for commodity volatility workflows.

Strike, skew, spread, and structure visuals aligned to tradable decision points.

Fits existing desk workflow instead of forcing another isolated terminal.

Start with a live walkthrough or a sample NG report to validate fit before procurement steps.

Trade replays

Each replay documents the setup, flow, and structure shift so desks can assess what was visible and when.

NG's wild week - an 80+ cent sell-off, March vol crushed 32%, and the winter rally narrative gets tested. Free weekly market recap.

Market Overview * Weather continued to add and market started talking about biggest draw ever and what price point we will need to fix it * It seemed that $5.00 OI...

Market Overview * And... just like that a 50 cent move * Market is now running in scared, what ifs mode * What if we get more weather with no SALTs or low SALTs *...

Strike-specific options flow, volatility structure shifts, and trader-focused market intelligence.

NG's wild week - an 80+ cent sell-off, March vol crushed 32%, and the winter rally narrative gets tested. Free weekly...

Market Overview * Weather continued to add and market started talking about biggest draw ever and what price point we...

Market Overview * And... just like that a 50 cent move * Market is now running in scared, what ifs mode * What if...

This platform is focused on one outcome: faster visibility into energy volatility dislocations with actionable positioning context.

Institutional workspace

Option matrix, spread matrix, flow scanner, weather overlays, and portfolio risk views in one operating surface.

Map where gamma exposure is concentrated across strikes and expirations before hedge feedback loops accelerate.

Monitor term structure and skew changes as weather and flow shift, instead of waiting for end-of-day snapshots.

Filter block activity and recurring structures so you can separate true positioning from one-off noise.

Surface spread and strike mispricings with risk-reward context for decision-ready trade review.

Keep your terminal workflow. Add Valor where energy vol structure needs deeper context.

Web platform, API access, and Excel compatibility for immediate desk deployment.

Weekly recaps include real strikes, flow, and skew language instead of generic macro commentary.

Institutional readiness

Receive the same strike-level flow and volatility commentary used by active energy options traders.

Prefer to validate first? Start with a sample NG report or book a live walkthrough.